What does DDP Incoterms mean?

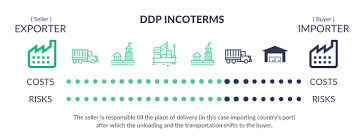

“Delivered duty paid” (DDP) is an international commercial term. This Incoterm is used for both sea freight and air freight imported goods. When shipping under this Incoterm, the seller takes on the most responsibility. DDP can be risky because the seller is in charge of delivery and may not know the local rules and requirements. This is especially true when Chinese factories say DDP.

The only rule that makes the seller responsible for import clearance, tax payments, and/or import duty is the DDP Incoterm rule.

The most important thing about DDP terms is that the seller is responsible for getting the goods through customs in the buyer’s country. This includes both paying the duties and taxes and getting the necessary permissions and registrations from the authorities in that country. If you don’t know a lot about the rules and regulations in the buyer’s country, DDP terms can be very risky, both in terms of delays and extra costs that you didn’t expect.

DDP Advantages for the Buyer

- The buyer doesn’t have to pay for any shipping costs, taxes, or other fees that come up during shipping and delivery. This can be helpful because shipping costs can be hard to predict because both the country of origin and the country of destination can have different inspection requirements. These costs are always passed on to the shipper.

- They don’t have any extra costs to figure in. As the name suggests, “delivered duty paid” means that the buyer is also paying for the cost of shipping and any duties. Once the products have arrived safely, they will not have to pay anything else.

- Once the products have been shipped, the buyer has to do is wait for their cargo to arrive and receive it. This can make the buyer feel a lot better because they know that the seller is responsible for anything that might happen to the products while they are in transit.

DDP Disadvantages for the Buyer

- There is a big chance of making a mistake because the supplier needs to know a lot about the destination country’s customs clearance, VAT, or import taxes. Even if the supplier is sure that their local freight forwarding company can help, the buyer has no way of knowing if the local agents are qualified to handle the delivery in the right way.

- When sellers are responsible for shipping, it is in their best financial interest to find the least expensive option. As in most fields, you get what you pay for. If a supplier chooses the cheapest but least reliable option, there is a much higher chance of problems, such as cargo being lost or damaged.

- When sellers are in charge of shipping, they almost always go with the slowest option because it costs them the lowest. DDP Incoterms takes away the buyer’s ability to control the delivery time or find ways to speed up the delivery process if they need to.

- When there are shipping delays, the buyer usually has to talk to the seller if they want to help fix the problem. Since sellers and buyers are often in different time zones, it takes longer to talk to each other. This can cause delays to last longer than if the buyer could talk directly to the local shipping agents.

What are the risks of using DDP terms for Seller and Buyer?

Risks for seller

The seller is in charge of getting the goods to their final destination and paying for the transportation. When the goods are brought into the buyer’s country, the seller is also responsible for paying any tariffs and taxes. When the goods are unloaded, the buyer is responsible for the risk.

Risks for Buyer

The buyer is in charge of getting the goods off the truck. When goods are shipped DDP, the risks are low, but the costs are high. When the shipment gets to the place named, the risk of loss or damage goes to the buyer.

Who pays for freight when use DDP?

Under DDP, the seller is responsible for all shipping costs and paperwork, such as export clearance and customs forms, that are needed to get the goods to the destination port.

DDP Incoterm responsibilities

DDP is the only hipofly.com/incoterms-guide/">Incoterms rule that says it is the seller’s job to clear the goods for import and pay any taxes or import duties.

Seller’s responsibilities

- Goods, commercial invoice and documentation

- Export packaging and marking

- Export licenses and customs formalities

- Pre-carriage and delivery

- Loading charges

- Main carriage

- Proof of delivery

- Import formalities and duties

- Cost of all inspections

- Delivery to named place of destination

Buyer’s responsibilities

- Payment for goods according to the terms of the sales contract

- Help the seller get any documents or information that are needed for export or import clearance

Conclusion

A Delivered Duty Paid shipping agreement is better for people who don’t know much about shipping and just want things to go smoothly. A seller with a lot of experience would also benefit from this system because they would have full control over their costs, including factors that could help them make the most money.

A DDP shipping agreement is a common way for companies to avoid incurring unnecessary costs when importing products from China.

FAQs

What is a Delivered Duty Paid (DDP) shipping agreement?

What is the difference between DDP and FOB?

In the case of the DDP Incoterm, the buyer pays for the fact that the seller can make the shipment less stressful because they are in charge of everything. In the same way, the seller can save money with good planning and networking, but in the end, the buyer will probably have to pay a little more because they no longer have to take care of the cargo or worry about its safety.

What is the difference between DDP and DDU?

Who pays freight on DDP term?

Does DDP include clearance of customs?

What is the difference between DDP and DAP?

Using incoterms for shipping can increase buyer confidence because they have less responsibility for shipping costs. This makes them more likely to buy products without worrying about being scammed or having to pay more taxes because of international shipping.

Both DAP and DDP shipping guarantee that the package will arrive at a named destination, which is important in international trade. By sea or air freight, the seller will be in charge of making sure the goods get to the agreed-upon place safely, which is good for both sides.