Welcome to the comprehensive guide on “Commercial Documents: Proforma and Commercial Invoices in International Trade.” In the complex landscape of global commerce, understanding the role of commercial documents is paramount. Among these, proforma and commercial invoices stand out as crucial components that shape the dynamics of cross-border transactions, negotiations, financial strategies, and regulatory compliance. This guide delves deep into the realm of these essential commercial documents, shedding light on their significance, differences, and impact on international trade. Whether you’re a business owner, entrepreneur, or trade enthusiast, embarking on this journey will empower you with insights that pave the way for successful global transactions.

What is a Proforma Invoice?

A China Customs Declaration is a crucial document among the Regulatory Documents for shipping from China. It serves as an official record submitted to Chinese customs authorities by exporters or shipping agents. This declaration outlines the details of the goods being shipped, including their description, quantity, value, and the intended destination. Its importance for shipping from China to worldwide destinations cannot be overstated.

Key Components of a Proforma Invoice

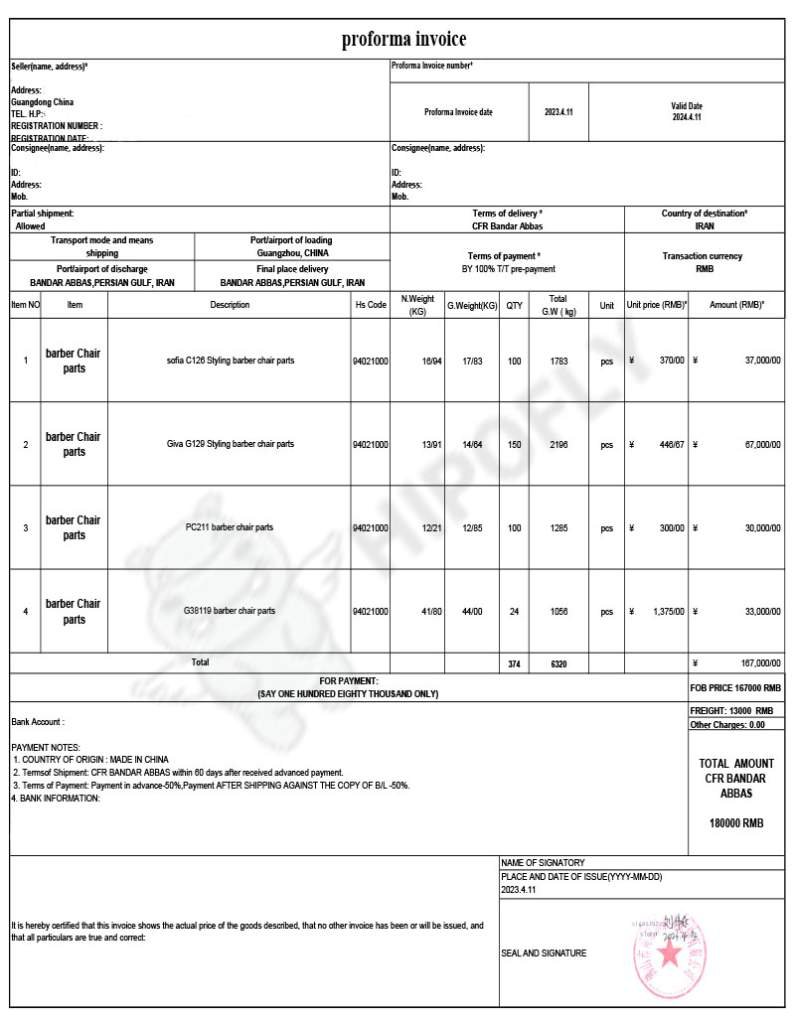

A Proforma Invoice, a pivotal player within the realm of commercial documents, encapsulates a range of vital elements crucial for informed trade transactions. This preliminary document presents a comprehensive overview of potential purchases, promoting clarity and understanding between buyers and sellers. The primary components include:

- Product Details: At the heart of the Proforma Invoice lie detailed product descriptions. These encompass the specifics of the goods or services being offered, outlining attributes, quantities, and unique identifiers.

- Pricing: The Proforma Invoice transparently lays out the costs associated with the transaction. This includes unit prices, total amounts, any applicable discounts, and the currency being used for the transaction.

- Terms and Conditions: This section outlines the conditions under which the transaction takes place. It encompasses payment terms, delivery details, shipping methods, and any special instructions for handling the goods.

- Payment Information: The Proforma Invoice elucidates the preferred payment methods and deadlines. This clarity ensures that both parties understand the financial aspect of the transaction.

- Validity Period: This component specifies the duration for which the Proforma Invoice remains valid. This aids in managing expectations and planning actions within a defined timeframe.

- Shipping and Handling: Here, information regarding shipping costs, methods, and estimated delivery dates is provided. These details enable buyers to gauge the total cost and expected arrival of the goods.

- Taxes and Duties: If applicable, the Proforma Invoice outlines any taxes, tariffs, or duties that need to be paid. This transparency helps avoid surprises during customs clearance.

- Contact Information: The document includes the contact details of both the buyer and the seller. This ensures effective communication throughout the transaction process.

- Additional Notes: Space for additional instructions or clarifications is often included, providing a platform to address unique aspects of the transaction.

In essence, the Proforma Invoice, a fundamental player in the realm of commercial documents, combines these crucial components to provide a holistic view of the potential transaction. This comprehensive breakdown assists in fostering transparency, understanding, and efficiency in international trade processes.

Advantages of Utilizing Proforma Invoices

Businesses opt for Proforma Invoices as a strategic tool, capitalizing on a multitude of advantages that these preliminary documents bring to the table. These benefits contribute to smoother operations, enhanced communication, and empowered decision-making throughout the trade process. Some key advantages include:

- Clarity and Transparency: Proforma Invoices offer a crystal-clear snapshot of transaction details, from product descriptions and quantities to pricing and terms. This transparency helps both parties align their expectations and reduce the likelihood of disputes or misunderstandings.

- Informed Decision-making: By presenting comprehensive information upfront, Proforma Invoices empower buyers to make informed decisions. They can assess costs, terms, and other specifics before committing to a purchase, facilitating confident and well-grounded choices.

- Financial Planning: Businesses, both buyers, and sellers, benefit from accurate financial planning. Buyers can budget effectively by understanding costs, while sellers can predict revenue streams and allocate resources accordingly.

- Efficient Customs Clearance: Proforma Invoices assist customs authorities in evaluating the goods accurately for classification and valuation. This contributes to expedited customs clearance, minimizing delays and potential additional charges.

- Negotiation Platform: The Proforma Invoice serves as a starting point for negotiations. Buyers and sellers can discuss terms, quantities, and pricing, ensuring alignment before progressing to the final sales contract.

- Risk Mitigation: By specifying payment terms and conditions, Proforma Invoices mitigate the risk of payment disputes or delays. This predefined structure promotes a secure and mutually agreeable transaction process.

- Facilitated Documentation: Proforma Invoices streamline documentation for international trade, serving as a foundation for creating formal sales contracts and other required paperwork.

- Professionalism and Credibility: Presenting a well-structured Proforma Invoice underscores professionalism and credibility in business dealings. It showcases a commitment to transparency and collaboration.

- Customization: Businesses can tailor Proforma Invoices to suit specific transaction requirements, incorporating additional details or instructions as needed.

- Legal Protection: In some cases, Proforma Invoices can serve as evidence of intent and terms in case of disputes, adding an extra layer of legal protection.

- Efficient Workflow: By eliminating uncertainties and confusion, Proforma Invoices contribute to smoother workflow processes for both buyers and sellers.

In conclusion, the utilization of Proforma Invoices reaps multifaceted benefits for businesses engaged in trade transactions. From enhancing clarity and informed decision-making to facilitating customs clearance and negotiation, these documents play a pivotal role in establishing efficient and trustworthy trade relationships

Disadvantages and Limitations of Proforma Invoices

While Proforma Invoices offer several advantages, they also come with certain disadvantages and limitations that businesses should be aware of. Understanding these drawbacks helps in making informed decisions and selecting the appropriate documentation for various situations. Here are some key considerations:

- Non-Legally Binding: Proforma Invoices are not legally binding contracts. They serve as preliminary agreements and do not hold the same legal weight as formal sales contracts. This can lead to ambiguity and potential disputes if the terms are not clearly understood or if circumstances change.

- Limited Legal Protection: Due to their non-binding nature, Proforma Invoices may not offer the same level of legal protection as formal contracts in case of disputes or breaches.

- Uncertainty in Complex Transactions: In intricate transactions involving multiple parties, products, or services, Proforma Invoices might not capture all nuances accurately. This can lead to misunderstandings or omitted details.

- Currency Fluctuations: Proforma Invoices often indicate prices in a specific currency. Currency exchange rate fluctuations between the time of issuing the Proforma Invoice and the actual payment could impact the final cost.

- Not Suitable for All Industries: Some industries, like those dealing with custom-made or highly specialized products/services, might find it challenging to fit all intricate details into a Proforma Invoice.

- Limited Flexibility: Proforma Invoices may lack the flexibility to accommodate changing terms or circumstances after they have been issued. This inflexibility could be problematic in dynamic business environments.

- Perception of Formality: In some cases, using a Proforma Invoice might suggest a less formal approach, which might not be suitable for larger or more established business relationships.

- Incomplete for Larger Transactions: For substantial transactions involving complex logistics, multiple payments, and various conditions, the simplicity of a Proforma Invoice might not suffice to capture all intricacies.

- Competitive Disadvantage: In highly competitive markets, sharing detailed pricing and terms upfront in a Proforma Invoice could potentially give competitors insights into the business strategy.

- Not Substitutes for Legal Advice: Relying solely on a Proforma Invoice without seeking proper legal advice could leave businesses exposed to risks and uncertainties.

- Limited Long-Term Value: Proforma Invoices are typically relevant for the short term, as they outline preliminary transaction terms. Their value diminishes as the formal sales contract is established.

- Cultural and Regional Differences: Some regions or cultures may not view Proforma Invoices with the same significance or may have different expectations regarding the content of such documents.

In conclusion, while Proforma Invoices provide a useful framework for trade transactions, they also come with limitations that businesses should consider. These drawbacks are context-dependent and should be weighed against the specific needs and complexities of each transaction. In certain situations, opting for more comprehensive and legally binding contracts may be a wiser choice.

Case Study: Application of a Proforma Invoice

Company: Tech Solutions Inc. (Fictitious Name)

Scenario: Tech Solutions Inc. is a technology company offering global software development services to clients. They’ve received an inquiry from a potential client, InnovateTech Corporation (Fictitious Name), for the development of a custom software solution.

Benefits of Using a Proforma Invoice in the Transaction:

- Transparency: The Proforma Invoice transparently presented the project scope and financials, enabling InnovateTech to make informed decisions.

- Budget Planning: InnovateTech could accurately estimate project costs and allocate budgets based on the details provided in the Proforma Invoice.

- Negotiation Platform: The Proforma Invoice served as a negotiation point, allowing both parties to align on project scope, terms, and costs.

- Initial Agreement: InnovateTech’s approval of the Proforma Invoice signified their initial commitment to moving forward with the project.

- Efficiency: The Proforma Invoice streamlined the negotiation process, saving time and effort before progressing to the formal contract stage.

In this real-world scenario, the Proforma Invoice facilitated transparency, negotiation, and initial agreement between Tech Solutions Inc. and InnovateTech Corporation for a software development project.

What is a commercial Invoice?

A Commercial Invoice is a crucial component of commercial documents, playing a central role in both international trade and domestic sales. This formal document serves as an official request for payment, providing a detailed breakdown of goods or services exchanged between sellers and buyers. Its significance extends beyond financial record-keeping, as it ensures transparency, accuracy, and compliance with legal requirements.

In essence, a Commercial Invoice encompasses essential transaction details, including item descriptions, quantities, unit prices, total amounts, payment terms, delivery methods, and the names and addresses of parties involved. This comprehensive information serves vital functions in various contexts:

In International Trade:

- Customs Clearance: Customs authorities rely on the Commercial Invoice to assess the accuracy of goods’ declared value, aiding in proper tariff classification and valuation for duty determination.

- Import Taxes: The detailed invoice data helps determine applicable import taxes and duties, ensuring adherence to importing country regulations.

- Logistics: Freight forwarders and shipping companies utilize the Commercial Invoice to verify goods’ specifications and value during transportation.

- Risk Management: A well-structured Commercial Invoice mitigates the risk of disputes by outlining agreed-upon terms and serving as evidence if conflicts arise.

In Domestic Sales:

- Payment Processing: The Commercial Invoice acts as a formal payment request, facilitating prompt transaction processing.

- Accounting: Businesses utilize Commercial Invoices for accurate financial record-keeping, aiding in audits, reconciliation, and financial analysis.

- Legal Support: A meticulously drafted Commercial Invoice offers legal protection and evidentiary value in cases of payment disputes or disagreements.

The Commercial Invoice’s multifaceted role makes it a cornerstone of commercial documents, fostering efficient trade relationships, regulatory compliance, and trust-building between buyers and sellers.

Key Components of a Commercial Invoice

A Commercial Invoice, an essential document within the realm of international trade and domestic transactions, comprises several mandatory components that provide a holistic view of the exchange. These key elements contribute to accurate financial documentation, customs clearance, and legal compliance. The mandatory components of a Commercial Invoice include:

- Seller’s and Buyer’s Information: The invoice should clearly state the names, addresses, and contact details of both the seller (exporter) and the buyer (importer).

- Invoice Number and Date: Each Commercial Invoice requires a unique identification number and a date of issuance for effective tracking and reference.

- Description of Goods: A detailed and accurate description of the goods being sold is essential. This should encompass the item’s name, model, quantity, unit of measurement, and any applicable product codes.

- Quantity and Unit Price: The Commercial Invoice should specify the quantity of each item being sold along with its corresponding unit price. This aids in calculating the total cost.

- Total Value: The total value of the goods, calculated by multiplying the quantity with the unit price, should be prominently displayed. This is crucial for customs valuation and financial reconciliation.

- Currency: The currency in which the transaction is conducted should be clearly indicated, enabling accurate financial calculations and conversions.

- Payment Terms: The agreed-upon payment terms, such as prepayment, credit terms, or payment upon delivery, should be outlined to prevent misunderstandings.

- Shipping Details: Information about the mode of transportation, shipping method, and expected delivery date should be included. This aids logistics and allows buyers to plan for receipt.

- Port of Entry: The specific port where the goods will enter the destination country should be mentioned for customs clearance purposes.

- Country of Origin: The country in which the goods were manufactured or produced should be indicated, as this is significant for tariff determination.

- HS Code or Tariff Classification: Including the Harmonized System (HS) code or tariff classification helps customs authorities categorize the goods for proper taxation and regulatory compliance.

- Freight and Insurance Charges: If applicable, the costs associated with freight and insurance should be itemized separately for clarity.

- Incoterms: The agreed-upon International Commercial Terms (Incoterms) that dictate the responsibilities and costs between the buyer and the seller should be clearly specified.

- Declaration of Authenticity: A statement confirming the authenticity of the information provided in the Commercial Invoice is often included.

- Authorized Signatures: Both the seller’s and buyer’s authorized signatures should be present, confirming agreement to the terms.

In essence, these mandatory components collectively ensure that a Commercial Invoice offers a comprehensive and accurate overview of the transaction, serving as a foundational record for financial, logistical, and legal purposes.

Advantages of Utilizing a Commercial Invoice

The utilization of a Commercial Invoice in international trade and domestic transactions brings forth a plethora of benefits for both buyers and sellers. This document, often considered a cornerstone of business interactions, offers valuable advantages that contribute to seamless operations, transparency, and compliance.

For Buyers:

- Transparency and Clarity: Commercial Invoices provide a clear breakdown of costs, item descriptions, and terms, empowering buyers with accurate information for decision-making.

- Budgeting Precision: The detailed invoice assists buyers in precisely budgeting for purchases, taking into account not only product costs but also associated charges like shipping and taxes.

- Customs Compliance: Accurate Commercial Invoices support smooth customs clearance by providing the necessary details for tariff classification and valuation, ensuring adherence to regulations.

- Legal Protection: The formal nature of a Commercial Invoice offers buyers a documented record of the transaction’s terms and conditions, providing legal protection in case of disputes.

- Financial Planning: The comprehensive information within the invoice helps buyers anticipate financial obligations and manage cash flow effectively.

For Sellers:

- Transparent Communication: Sellers can establish transparent and clear communication with buyers by providing a comprehensive overview of the transaction’s details.

- Reduced Disputes: A well-structured Commercial Invoice minimizes the likelihood of disputes by outlining agreed-upon terms and quantities.

- Payment Clarity: The invoice acts as an official demand for payment, ensuring clarity in payment processing and reducing delays.

- Accurate Record-Keeping: Sellers maintain Commercial Invoices as official transaction records, aiding in accounting, audits, and financial analysis.

- Legal Compliance: Detailed and accurate Commercial Invoices contribute to legal compliance, preventing potential penalties due to inaccuracies or omissions.

- Trust-Building: Providing buyers with well-documented Commercial Invoices enhances the perception of professionalism and reliability, fostering trust and strong business relationships.

- Efficient Logistics: Accurate information in Commercial Invoices supports efficient logistics management, aiding in shipping coordination and customs procedures.

The advantages of using a Commercial Invoice extend to both buyers and sellers, offering a range of benefits that span from transparency and budgeting precision to legal protection and efficient logistics. This document serves as a vital tool in promoting trust, compliance, and effective communication within the realm of commercial transactions.

Disadvantages and Limitations of Commercial Invoice

Despite their importance in international trade and domestic transactions, commercial invoices are not without their potential drawbacks and limitations. It’s crucial to understand these complexities to effectively manage challenges that might arise:

- Inaccuracies and Errors: The detailed nature of commercial invoices makes them susceptible to inaccuracies, such as incorrect product descriptions, quantities, or values. These errors can lead to disputes and delays in processing.

- Language and Cultural Variations: In global transactions, differences in languages and cultural interpretations can impact the accuracy and clarity of information presented in the commercial invoice, potentially leading to misunderstandings.

- Complex Transactions: For multifaceted deals involving numerous items, services, or parties, fitting all pertinent details into a single commercial invoice can be daunting. This complexity might result in overlooked aspects.

- Legal Enforceability: While commercial invoices are vital for transaction records, they might lack the legal enforceability of formal contracts. This limitation can hinder their effectiveness in dispute resolution and legal proceedings.

- Limited Flexibility: Once issued, making changes to commercial invoices can be cumbersome. This lack of flexibility becomes challenging when modifications are needed after buyer approval.

- Currency Fluctuations: The use of specific currencies in commercial invoices can lead to discrepancies caused by currency exchange rate fluctuations between invoice issuance and payment settlement.

- Privacy Concerns: Commercial invoices typically contain sensitive business information. Sharing them with parties beyond the buyer and seller might raise privacy and security concerns.

- Dependence on Technology: In an increasingly digital world, reliance on technology for creating, transmitting, and storing commercial invoices brings the risk of technical glitches, data breaches, or cyberattacks.

- Competitive Insights: Commercial invoices can provide competitors with insights into pricing strategies and business relationships, potentially impacting a company’s competitive edge.

- Lack of Standardization: Different countries and industries might have varying expectations for the content and format of commercial invoices, leading to inconsistencies and confusion.

- Environmental Impact: Traditional paper-based commercial invoices contribute to paper consumption and environmental impact. The transition to digital formats can mitigate this concern.

Lastly, while commercial invoices are essential commercial documents, being aware of their disadvantages and limitations helps businesses proactively address potential challenges and enhance the overall efficiency of trade transactions.

Case Study: Application of a Commercial Invoice

- Company: Global Electronics Ltd. (Fictitious Name)

- Scenario: Global Electronics Ltd. is a supplier of electronic components operating internationally. They receive an order from a well-established distributor, TechLink Distribution (Fictitious Name), for a bulk purchase of microcontrollers.

Benefits of Using a Commercial Invoice in the Transaction:

- Transaction Transparency: The Commercial Invoice offers a transparent breakdown of costs and terms, fostering trust between Global Electronics and TechLink Distribution.

- Customs Compliance: The Commercial Invoice aids in customs clearance by providing accurate product details and values for tariff assessment.

- Payment Reference: The Commercial Invoice serves as a reference for payment processing, ensuring that the agreed-upon amount is settled.

- Accounting Accuracy: Both companies maintain Commercial Invoices for accurate financial tracking, enhancing accounting and audit processes.

In this real-world scenario, the Commercial Invoice streamlined the transaction between Global Electronics Ltd. and TechLink Distribution, ensuring accurate information sharing, payment processing, and compliance with customs regulations.

Comparison Between Proforma and Commercial Invoices

Comparing the proforma invoice and the commercial invoice is a pivotal undertaking that sheds light on two distinct but interrelated documents within the realm of international trade and transactions. The intent of this comparison is to unravel the nuances, purposes, and implications of these invoices, equipping businesses with a comprehensive understanding of their roles.

In the intricate landscape of global trade, both proforma and commercial invoices play crucial roles in outlining terms, facilitating financial transactions, and ensuring regulatory compliance. Recognizing the differences and similarities between these documents is paramount for businesses seeking clarity and efficiency in their operations.

Understanding these invoices’ distinctions empowers businesses to navigate negotiations, budgeting, and logistics effectively. Recognizing the similarities helps build a foundation for accurate record-keeping, communication, and building trust between trading partners.

In essence, this comparison serves as a navigational guide for businesses, enabling them to make informed decisions, foster transparent relationships, and optimize their trade processes within an increasingly interconnected global market.

Comparison Between Proforma and Commercial Invoices

Both the proforma invoice and the commercial invoice share fundamental attributes that establish consistency and clarity within the transaction process. These common elements ensure that essential information is conveyed to both parties, facilitating accurate communication, transparent financial dealings, and regulatory adherence.

The description of goods or services provides a detailed overview of what is being exchanged, preventing misunderstandings. The inclusion of quantity and unit price assists buyers in calculating costs and evaluating the value of the transaction. Displaying the total value offers a comprehensive understanding of the financial scope.

Identifying the parties involved, i.e., the buyer and seller, ensures clarity in roles and responsibilities. The assignment of an invoice date and number enables organized tracking and referencing.

Outlining payment terms clarifies when and how payments should be made, promoting timely transactions. The indication of the currency ensures that both parties are aligned on the financial terms.

Lastly, the inclusion of legal compliance information underscores transparency and ensures that both parties are aware of any legal disclaimers or terms associated with the transaction.

By sharing these common attributes, both types of invoices contribute to a structured, transparent, and mutually understood transaction process.

Differences in Purpose and Scope

The proforma invoice and the commercial invoice serve distinct purposes and cater to different stages of a transaction, each with its own scope and implications:

Proforma Invoice:

- Purpose: The proforma invoice serves as a preliminary agreement between buyer and seller. It provides an initial offer and outlines key terms and conditions to initiate discussions and negotiations.

- Intent: Its primary intent is to present an overview of what the transaction could entail, allowing both parties to assess feasibility and establish a mutual understanding.

- Legally Binding: Generally, a proforma invoice is not considered legally binding and doesn’t require the same level of commitment as a commercial invoice.

- Transaction Stage: It’s used in the early stages of negotiation and planning, helping both parties align on terms before formalizing the agreement.

- Scope: It covers provisional terms and conditions, facilitating initial discussions without committing either party to a complete transaction.

- Customs Use: Proforma invoices are not commonly used for customs clearance; their focus is on negotiation rather than compliance.

- Payment Reference: Proforma invoices are not typically used as direct references for payment; they serve as an estimation for budgeting.

- Flexibility for Changes: They offer more flexibility for changes before an agreement is reached.

Commercial Invoice:

- Purpose: The commercial invoice serves as a formal demand for payment after goods or services have been delivered. It’s a legally binding document.

- Intent: Its primary intent is to ensure the timely and accurate processing of payment for completed transactions.

- Legally Binding: A commercial invoice is legally binding and holds parties accountable for the agreed-upon terms and payment.

- Transaction Stage: It’s used in the final stage of the transaction, providing comprehensive details after the exchange is complete.

- Scope: It covers detailed transaction information, including quantities, prices, terms, and parties’ details, ensuring clarity and accuracy.

- Customs Use: Commercial invoices are essential for customs assessment and clearance, aiding in accurate valuation and tariff determination.

- Payment Reference: Commercial invoices are directly used for payment reference, ensuring that the correct amount is settled.

- Flexibility for Changes: They offer limited flexibility, as they represent a completed transaction and serve as the basis for payment.

In summary, the differences in purpose and scope between the proforma invoice and the commercial invoice highlight their unique roles in different stages of a transaction, from initial negotiations to finalized deals and payment processing.

Legal Implications of Proforma and Commercial Invoices

The legal implications surrounding proforma invoices and commercial invoices are distinct, reflecting their respective roles in the transaction process and their treatment by regulatory authorities. Understanding these differences is crucial for businesses engaging in international trade to ensure compliance and mitigate potential legal challenges.

Proforma Invoice:

-

Non-Legally Binding: Proforma invoices are generally considered non-legally binding documents. They serve as preliminary offers and are used to initiate discussions and negotiations. Consequently, they do not carry the same legal weight as formal contracts.

-

Negotiation Basis: Proforma invoices primarily act as a basis for negotiations. They outline terms and conditions that are subject to further agreement. Any commitments made in a proforma invoice can be subject to change until formal agreement is reached.

-

Customs Clearance: Regulatory authorities typically do not use proforma invoices for customs clearance purposes. They focus more on the final transaction details provided in commercial invoices.

Commercial Invoice:

-

Legally Binding: Commercial invoices hold significant legal weight. They are considered legally binding documents that outline the agreed-upon terms, including the quantity, quality, price, and other transaction details.

-

Transaction Verification: Regulatory authorities rely on commercial invoices to verify the accuracy of transactions, especially for customs clearance. These invoices provide the foundation for determining the value and classification of goods.

-

Payment Demand: Commercial invoices serve as formal payment demands, indicating the exact amount owed by the buyer to the seller. Failure to comply with the terms outlined in a commercial invoice can have legal consequences.

-

Evidence in Disputes: Commercial invoices can serve as crucial evidence in legal disputes. If there are disagreements or breaches of contract, commercial invoices provide documentation of the terms agreed upon by both parties.

lastly, proforma invoices are preliminary documents used for negotiation and discussion, while commercial invoices carry legal weight, serving as formal payment demands and transaction records. Regulatory authorities treat them differently, relying on commercial invoices for customs clearance and transaction verification. Businesses must be aware of these distinctions to navigate international trade regulations accurately and ensure legal compliance.

Comparing Roles and Financial Implications of Commercial Documents

Role in International Trade

Financial and Tax Considerations

In the realm of international trade, a comparison between proforma invoices and commercial invoices reveals distinct roles and financial implications. Proforma invoices serve as preliminary tools, initiating discussions by outlining potential transaction details and enhancing transparency. They lack legal binding for clearance and payments, offering flexibility during negotiations. On the other hand, commercial invoices play a pivotal role as legally binding records of completed transactions. They form the basis for customs clearance, demand precise payments, and ensure accurate accounting, tax compliance, and dispute resolution. Financially, proforma invoices offer cost estimates but may lack legal weight for formal accounting, potentially impacting revenue recognition. Meanwhile, commercial invoices significantly influence financial matters, serving as a foundation for accurate accounting and payment processing, ensuring financial transparency and regulatory compliance in international trade.

Conclusion

In wrapping up this comprehensive guide, we’ve explored the intricate aspects of trade documentation through the lenses of both the proforma invoice and the commercial invoice. By diving into their distinct roles, advantages, limitations, and real-world applications, we’ve gained a well-rounded understanding of their significance in the realm of international trade and domestic sales processes. By drawing comparisons and contrasts, we’ve highlighted how these documents play pivotal roles in negotiations, financial planning, compliance, and transactional accuracy.

In the context of this guide, let’s consider the scenario of Hipofly Shipping Company. From the viewpoint of this shipping company, the proforma invoice emerges as a valuable tool to initiate transparent communication with clients. Its role in outlining potential transaction terms and facilitating negotiations empowers clients to make informed decisions before formal agreements are established. On the other hand, the commercial invoice takes on a more profound role in Hipofly’s financial operations. Ensuring accurate payment processing, maintaining financial records, and adhering to regulatory compliance underscores its significance. This document not only facilitates customs procedures but also proves to be a reliable source in dispute resolution and adherence to legal mandates.

As you delve into the intricacies of commercial documents, it’s crucial to grasp the diverse array of essential paperwork that underpins international trade. Beyond the realms of proforma and commercial invoices, exploring the articles on Transportation Documents, Regulatory Documents, Quality and Compliance, Special Goods Documents, Insurance, and Other Potential Documents becomes paramount. Each article offers a deep dive into a specific facet of the trade ecosystem, revealing the critical role it plays in ensuring successful cross-border transactions. So, if you’re eager to elevate your understanding of international trade, we encourage you to embark on a journey through these insightful articles, each providing valuable insights that collectively contribute to a holistic comprehension of this dynamic landscape.

Commercial documents are crucial paperwork that facilitate transactions between buyers and sellers in the global market. They include documents like proforma invoices and commercial invoices, outlining transaction terms, prices, and essential details.

The main distinction lies in their legal status and purpose. A proforma invoice is a preliminary offer used to initiate discussions and negotiations, while a commercial invoice is a legally binding document that demands payment after goods or services are delivered.

A proforma invoice serves as an initial point of agreement, allowing parties to assess terms and conditions before finalizing a deal. It fosters transparency and mutual understanding during the negotiation process.

A commercial invoice is a cornerstone of financial reporting in international trade. It ensures accurate accounting, aids in revenue recognition, and provides evidence for tax compliance, making it essential for maintaining financial transparency.

Generally, proforma invoices are not used for customs clearance. Customs authorities rely on commercial invoices, which provide comprehensive transaction details and accurate valuation for customs assessment.

Commercial documents like proforma and commercial invoices provide clarity, transparency, and legal protection. They aid in negotiation, demand payments, streamline financial processes, and ensure compliance with international trade regulations.

Proforma invoices are typically not legally binding as they serve as preliminary offers. They outline terms for discussions and negotiations but do not hold the same legal weight as formal agreements.

Commercial invoices are critical for customs clearance, accurate payment processing, and financial record-keeping. They serve as evidence in case of disputes and ensure compliance with regulatory requirements.

Yes, commercial invoices can be used as crucial evidence in legal disputes, showcasing the agreed-upon terms and transaction details between parties involved.

Commercial documents enhance transparency, mitigate misunderstandings, and establish a common understanding between parties. They build trust by formalizing agreements, ensuring payment commitments, and providing accurate transaction records.